If you’re new to payday loans, the process might seem confusing—but it doesn’t have to be. At Fast Payday Loans, Inc., we make it quick and straightforward to qualify, apply, and get your cash when you need it most.

Below, we’ll explain what a payday advance loan is, what you need to apply, and how to complete the process from start to finish.

What Is a Payday Advance Loan?

A payday advance loan—also known as a payday loan or cash advance—is a short-term loan designed to help you cover urgent expenses before your next paycheck arrives. These loans are meant for temporary financial gaps such as car repairs, medical bills, or unexpected home costs.

Unlike traditional bank loans, payday advances:

-

Don’t require collateral (they’re unsecured loans)

-

Have simple qualification requirements

-

Can often be approved and funded on the same day

Borrowers agree to repay the loan—plus any applicable fees or interest—on their next payday or within a short period, typically two to four weeks. Because they’re fast and accessible, payday advances can be a useful solution for emergencies when time is critical.

What You Need To Apply

To qualify for a Florida payday loan, you only need three key documents. Each requirement confirms your identity, income, and ability to receive funds securely.

1. A Valid State-Issued ID

Florida law requires borrowers to be at least 18 years old. You can use your driver’s license or another state-issued photo ID to verify your identity.

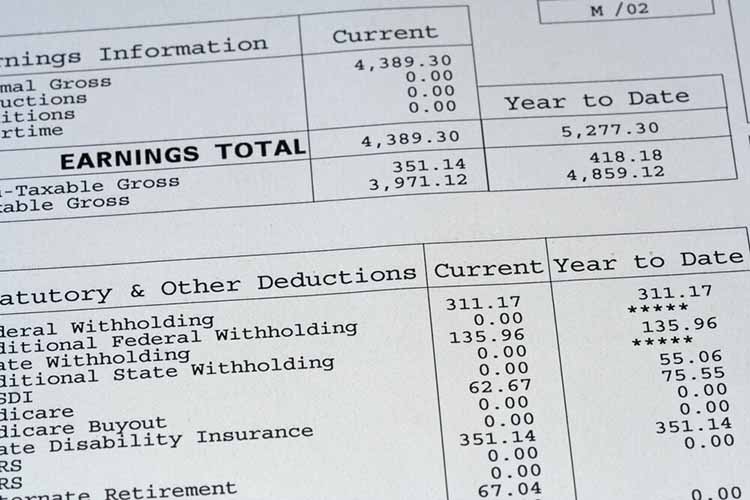

2. Proof of Income

Because payday loans are unsecured, lenders need to confirm that you can repay the loan. The most common form of proof is a recent pay stub, but not everyone has a traditional paycheck.

You may also qualify using:

-

Unemployment or welfare benefits

-

Court-ordered payments (such as alimony or compensation)

-

Pension or retirement income

-

Savings account statements

Ask your loan representative which documents apply to your situation.

3. An Active Checking Account

To deposit your loan funds and process repayment, you’ll need an active checking account in your name. You can verify this by bringing a blank check from that account to your meeting.

Once you have these three documents, you’re ready to apply!

How the Payday Advance Process Works

Applying for a payday loan in Florida takes just a few minutes:

-

Fill out the online form. Submit your contact details and basic information to connect with the nearest Fast Payday Loans, Inc. branch.

-

Get a quick call. A loan representative will review your application, confirm your documents, and set up a convenient in-person appointment.

-

Meet and finalize. Bring your required items to the branch. Once your paperwork is reviewed, you’ll learn how much you qualify for and can complete the loan process on the spot.

Most customers receive their funds the same day or by the next business day.

Understanding Payday Loan Responsibilities

Before signing, it’s important to understand your financial obligations. Payday advances are short-term loans that must be repaid—usually on your next payday. Failing to repay on time may result in additional fees or interest.

Always borrow only what you can comfortably repay, and ask your loan representative about repayment terms and extensions if needed.

FAQs About Payday Loans in Florida

Can I get a payday loan if I’m self-employed?

Yes. You can provide alternate proof of income, such as bank statements or tax records, instead of a traditional pay stub.

Do payday loans affect my credit?

Payday loans typically do not appear on your credit report unless the account goes into collections.

How quickly can I get my money?

If approved, you can often receive your funds the same day you apply.

Can I apply if I receive benefits instead of wages?

Yes. Alternate income sources such as benefits, pensions, or alimony can often be accepted.

Apply for a Payday Loan Today

Now that you know exactly what’s needed, you can apply for your first payday advance in Florida with confidence. Gather your three required documents, fill out the quick online form, and get up to $1,000 to handle urgent expenses fast.

At Fast Payday Loans, Inc., we’ve simplified every step of the process so you can get the cash you need—without the wait.

Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.